In this newsletter I usually write about the economy, markets or investments – but today I thought I’d look at the active vs passive fund management debate and why we think active fund management is more important than ever before.

First it’s important to be clear about the difference between an active and a passive fund manager. An active fund manager is someone like Fisher Funds – where out of the 40,000+ companies listed on stock exchanges globally we are able to invest in a very select group of stocks after a comprehensive and in-depth research process. Because of this research (that is constantly reviewed) we are confident that this particular combination of stocks can outperform the market over time and deliver the best possible returns for our investors.

A passive manager by contrast buys a much broader selection of the stocks in an index, regardless of quality. This broad-based approach means it's impossible to outperform the market in the long-term. There’s nothing fundamentally wrong with the passive approach if that is what you’re after. But you need to be clear about the fact that choosing a passive fund could result in a lower after fees returns in the long-term.

Active more important than ever

We believe that the current market outlook will mean that an active investment approach will become more important than ever. In recent years investors globally have been lucky enough to have had a period of fantastic market returns and, in that environment, any extra return over and above the market due to its active management has been the icing on the cake.

However, these types of returns are not normal and in fact represent an incredible run for all investors. As such as we enter into a potentially lower return world, that extra active management return could become the whole cake as average market performances falter.

Yes, there will still be plenty of opportunities out there if you take an active approach and pick the right stocks but relying on a broad based passive approach is unlikely to deliver the returns it has in recent years and that investors have become accustomed to.

Still the number one ranked KiwiSaver team

Our investments in our advice and investment team talent in recent years have paid off for clients and we intend to continue investing in these areas.

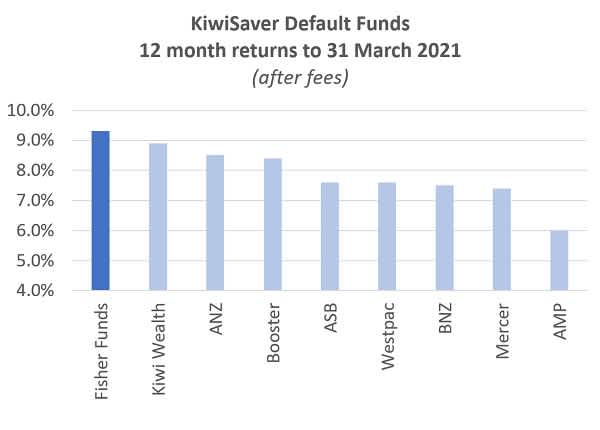

Over the last year Fisher Fund’s default fund outperformed all other default providers.

Selecting a longer time frame than one year, our Fisher Funds KiwiSaver Scheme Growth Fund ranked 1st out of 27 funds for returns over the three years to 31 March 2021. At the 2021 INFINZ awards, our investment performance was acknowledged by leading industry professionals with two prestigious awards – ‘Fund Manager of the Year’ for both Equities and Bonds.

On top of investment performance, we were awarded a Super Ratings Platinum Award for delivering the best value for money for clients as well as being voted a Most Trusted Brand by Reader's Digest.

Fisher Funds is committed to KiwiSaver, and more importantly to delivering leading investment performance, service and value for money for our clients.

Make sure you don’t get a raw deal

For most of our clients the recent default provider news will have no impact. If you have selected Fisher Funds yourself, or have talked to us and made an active choice to invest in a fund (even if that fund is our default), then there is nothing you need to do.

However, we do have some clients that have not made an active choice. We will try to get in touch with these clients individually in the coming months, but if you believe this may apply to you then please give us a call on 0508 347 437 to check. We can help select the right fund for you and make sure that you continue to benefit from our active management approach before the government switches you to a provider who may take a passive investing approach.

After all we all know that being active is best!