There is no manual for being a good parent. Most of us wing it on natural instinct, and the vast majority of children end up as good citizens. We also know many are financially challenged. Why is it that parents are generally good at teaching basic survival skills like personal safety and nutrition, but fall so materially short when it comes to monetary survival skills? The basics can be easily understood.

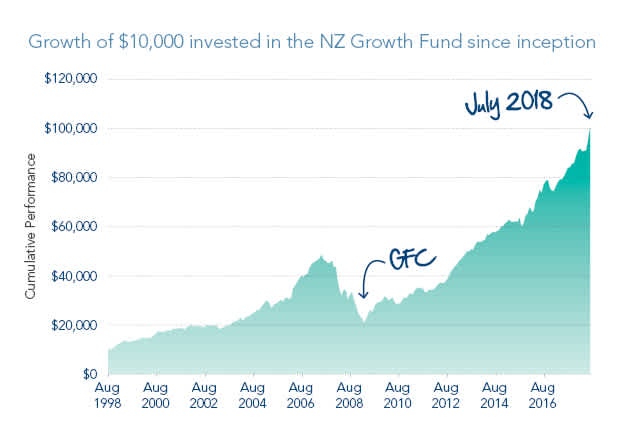

Fisher Funds will celebrate it’s 20th birthday in August 2018, and provide evidence of the most basic lesson that every teenager should learn. On August 1998 Carmel and Hugh Fisher launched the Fisher Funds New Zealand Growth Fund and the performance of this fund over the last 20 years is shown on the graph on this page.

This has been an eventful two decades. It started with the Asian crisis, endured the worst of the global financial crisis, multiple changes of government, new regulations, major natural disasters like earthquakes, company failures and so on. Despite all of this, $10,000 invested in this fund in 1998 is still worth around $100,000 today. That is a compound return of 12.2%. Who would have thought this was possible with all of this negativity? This is no fluke and no get rich quick scheme. It is the disciplined following of basic monetary principles. Long term compounding, investing not gambling, diversification and holding the course with quality companies.

Why is it that the basics of long term investment in equities is not something that is shared with our younger generations? Teenagers are more likely to hear that shares are risky and “watch out for the next crash”, rather than the basics of equity investment. In todays new world where home ownership is dropping because of the excessive price levels, we need our younger generations to understand the value of equities as an alternative asset class to property and bank deposits.

Of course the Fisher Fund New Zealand Growth Fund has benefitted from the Carmel Fisher signature through most of the above period. The investment philosophy and process has been ingrained within the business and is today continued on by a new wave of investment professionals in our investment team who are continuing and enhancing these philosophies and investment processes. This fund is truly a success story. It is also a demonstration of other New Zealand success stories. Companies like Freightways, Delegat Wines, Mainfreight and Ryman Healthcare have been long term investments of the fund and investors have profited from them.

We at Fisher Funds will celebrate the 20 year milestone and marvel at the long term performance of one of our signature funds. Thank you to those of you who have stayed the course and reaped the benefit. Our prize is to endeavour to do this all over again in the next 20 years.

Governance Changes

In late July we welcomed two new Directors to the Board, Guy Roper and Jennifer Moxon.

Guy is currently CEO of Port Taranaki since 2015 and also a Trustee of the TSB Community Trust while Jennifer is a professional Director having previously had a career for over 30 years at IBM.

Concurrently with these appointments there was also an end of an era. Carmel Fisher retired as a Director and that brought an end to the amazing 20-year ownership, executive and governance time at Fisher Funds since founding the business in 1998. Carmel sold her remaining shares in Fisher Funds in 2017, but had stayed on as a Director to ensure a successful transition of the business to the new controlling shareholder, the TSB Community Trust. Carmel’s legacy will live on at Fisher Funds long into the future, as is evidenced by her launch fund, the New Zealand Growth Fund.