Investors looking at their investment balances will notice the start to the year has been a strong one, particularly in more growth-oriented funds. Global shares gained 4.1% in February, helped in part by strong earnings reports from big US tech stocks like Meta Platforms and Nvidia.

Global economic strength and big tech earnings outweigh concerns around sticky inflation

The market rally has been driven in part by stronger-than-expected economic growth and employment data. This stronger data and persistent inflation have seen expectations for interest rate cuts pushed out, and while last year this may have caused a surge in share market volatility, it has been taken in stride this year as corporate profits are also firmly on the rise.

With most S&P 500 companies having reported financial results for Q4 2023, their earnings announcements showcased continued corporate resilience. Earnings growth hit nearly 8% in Q4, far surpassing the initial projections of a 1% increase.

Focus was once again on members of the "Magnificent Seven" tech giants, whose earnings performance helped propel the S&P 500 past the 5,000 threshold for the first time. These seven major companies – Microsoft, Apple, Nvidia, Amazon, Meta, Alphabet, and Tesla – recorded a 59% profit surge in the fourth quarter. Excluding these firms, the rest of the index posted a 2% decline in profits.

The significant impact of these companies on the market's overall performance has sparked concerns about the market's increasing concentration. The "Mag 7" now comprise roughly 30% of the S&P 500. Including the next three largest stocks (Berkshire Hathaway, Eli Lilly, and Broadcom), this concentration climbs to about 33% of the index. With the current rally being narrowly focused, are markets more vulnerable to a setback?

Putting market concentration in context

There have been other periods where US stock concentration has been higher than it is now. In the 60s and 70s the concentration of the top ten stocks in the US S&P 500 index increased to more than 40% for several years – this group was composed of blue-chip stocks such as Coca-Cola, AT&T and IBM. Back in the early 1900s, the railway sector accounted for more than half of the US stock market.

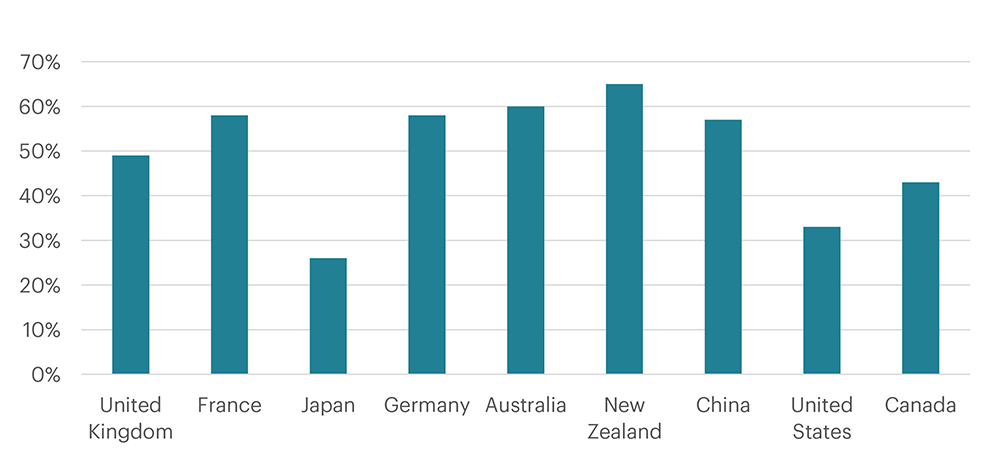

A comparative look at global markets underscores this point further. In numerous countries (including NZ and Australia), the top ten stocks make up more than half of the total market capitalisation. This data underscores the point that high concentration isn’t uncommon and doesn’t need to pose a threat.

Comparison with the dotcom bubble

Those anxious about the recent surge in big tech companies and increasing market concentration point back to the dotcom bubble, when big tech concentration was similar to today. Back in 1999 it turned out that these tech companies were over-hyped, too expensive and didn’t have the earnings to support their elevated share prices. Today, many of the Mag 7 have leading positions in their markets, attractive margins, growing profitability, and reasonable valuation metrics.

What happens from here?

How the Mag 7 perform from here will depend on the fundamentals of each of these companies – not on the concentration of this group of companies. This creates opportunities for active investors.

The beginning of 2024 has already witnessed a divergence in performance of the top 10, emphasizing the importance of a long-term investment strategy focused on fundamentals and earnings potential rather than chasing short-term hype.

We currently own four of the top 10 US stocks in our active global funds, but they are selected purely on fundamental characteristics: like their growth prospects, the quality of their management teams, their competitive advantages and valuations. We believe some of the top 10 are currently over-priced and risky, while some still present good investment opportunities.

While the Mag 7 get a lot of focus, there are thousands of other companies out there to invest in. Diversification is important, and we have recently been expanding our investments in areas like healthcare, recognising the defensive qualities of many of these businesses, and the ongoing significant potential for growth.

All considered, we don’t think the high market concentration is a risk in and of itself, but it provides a good reminder of the importance of researching companies one-by-one and being highly selective.

Need some help?

If you have any questions about your investment or would like to make sure you have the right investment strategy to reach your ambitions, get in touch with us – our team are always happy to help.