Inflation erodes the value of cash through time. Investors need to think about how to offset the impact inflation has on their wealth when planning for retirement. Investing in growth assets like managed funds and property can provide long-term inflation protection.

One of the members of our investment team fondly recalls a time when he could get a pie and a donut for $1. However, at the bakery nearest to the Fisher Funds office, these days Brent won’t get much change from $8. While inflation and its underlying drivers can be a difficult concept to explain, it is easy to see its implications. A dollar earned today is unlikely to buy as much in the future. And while we may not notice the effect from year-to-year, it can have a big impact when investing and planning for a retirement that may span 30+ years.

Talk of rising inflation

There has been a lot of talk in the financial press recently about the prospect of rising inflation after years of stable prices. The argument is that inflationary forces are building. Money printing by central banks, recent government stimulus (including President Biden’s recently announced US$1400 per person stimulus cheques), and pent-up savings from lockdowns mean that once the vaccine is rolled out we may get a huge spending surge and therefore inflation.

Harry Smith, our Senior Investment Analyst, talks more about our views on inflation here. Whether or not we experience high or just moderate inflation, it is worth understanding how it can impact your savings and potential income in retirement.

Inflation erodes the value of cash in the bank

While a certain amount of inflation often comes hand in hand with a healthy economy, inflation does eat away at the value of cash. High inflation, like we saw in New Zealand in the 1980s can be particularly damaging for savers. When planning for retirement we all need to take inflation into account.

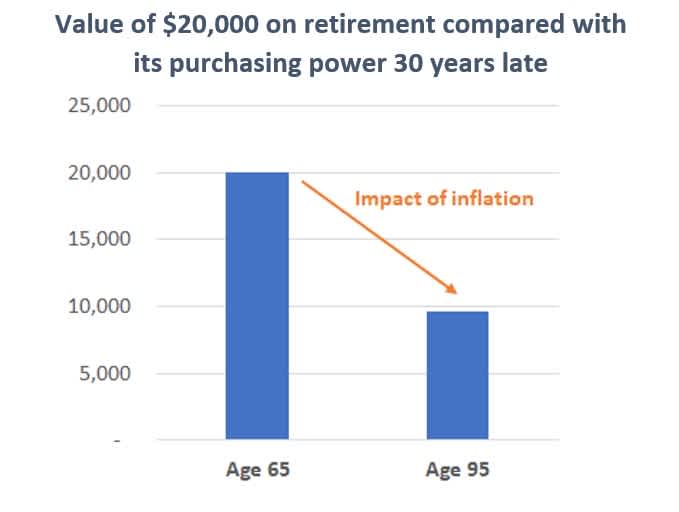

If someone retired today at age 65 with $600,000 in savings they may figure they can withdraw $20,000 each year until they are 95. While this is true, unfortunately, due to inflation $20,000 won’t buy as much in 30 years as it does now. With 2.5% annual inflation the purchasing power of this savings would fall to $9,600 by the time this retiree was 95. If inflation spiked for a period above 2.5%, then the impact would be even more dramatic. Another way to think about this is that the cost of Brent’s pie and donut may go up from $8 today to more than $16 in 30 years' time.

Growth investments can offset the impact of inflation

Thankfully, there are things investors can do to offset the damaging effect of inflation. While the value of cash is eroded by inflation, this isn’t necessarily the case for real assets like shares and property. While inflation can be disruptive in the short term, good businesses can ultimately pass through the effects of inflation by increasing prices. Over time company profits therefore increase by inflation plus any real growth the companies are able to deliver. This has resulted in higher share prices and attractive real returns for investors from the share market.

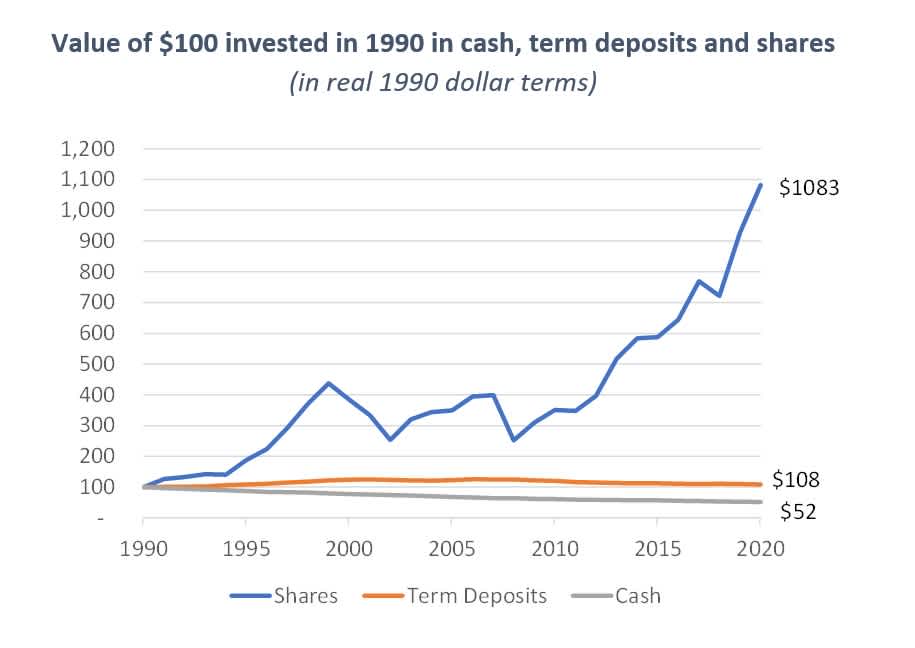

The chart below shows the value (in 1990 dollars) of $100 if it was either held as cash (no interest), invested in term deposits, or invested in the share market (we use United States data here because the long-term data is more readily available than for New Zealand). The chart shows that $100 left in cash for 30 years would have had its purchasing power eroded to $52. Investing in term deposits would have seen a slight increase in the real value of the investment after inflation, but only by $8 over 30 years. On the other hand, $100 invested in the US share market would have grown to $1,083 in value – even after taking into account the damaging impact of inflation.

Growth assets as a diversifier

Cash is often talked about as being low risk and a good portfolio diversifier. While cash may be low risk over the short-term, it clearly doesn’t protect investors very well from the risks posed by inflation. This is one reason long-term investors need to have a diversified portfolio, not just a ‘conservative’ portfolio. The long-term corrosive impact of inflation highlights the benefits of having exposure to growth assets like shares – even well into retirement.