The shock invasion of Ukraine by Russia has added another risk to the list of investor concerns. Inflation, interest rates hikes, a share market correction – and now a war. While selling investments or switching strategy ‘until the coast is clear’ might feel like the right thing to do in turbulent times, snap decisions can also do significantly more harm than good. While the environment may feel grim now, markets tend to climb as the wall of worries recedes.

An unsettling start to the year

The first two months of 2022 had been troubling for investors, even before the turbulence caused by Russia’s shocking invasion of Ukraine. The list of concerns on investors’ minds has grown significantly over the last six months, with the wall of worry including:

Persistently strong inflation

Central banks starting to lift interest rates

Central banks unwinding quantitative easing

A share market correction (hitting tech and growth companies hardest)

The Omicron wave in New Zealand

Adding the Russian invasion to this list has ratcheted investor anxiety up a few notches higher.

The Russia / Ukraine escalation has the biggest short-term implications

The Russian invasion of Ukraine is first and foremost a terrible human tragedy. The financial implications of the Ukraine conflict are also broad and worth considering - particularly given Russia’s importance to energy supply.

Oil prices have spiked from $95 to over $110 a barrel since the invasion, which will have implications for consumers in all countries. This comes at a time when inflation is already running hot and household budgets are under pressure. Another risk is to Europe’s gas supply, c.40% of which is sourced from Russia. A disruption could have significant impacts on Europe’s industrial sector, and the economy more broadly. This is before considering the risk of the war escalating and extending beyond Ukraine.

The impacts of these risks depend on how far the conflict escalates. If it remains a narrow conflict, with no impact on the flow of energy, then the impact on the global economy may be limited. This helps explain the lack of initial reaction in financial markets to the invasion (US markets actually gained). The list of investor worries was already long, investors were already pessimistic, and investors had already contemplated the risk of invasion – including scenarios with more severe energy sector and economic implications.

The risk du jour is constantly changing

The current inflation debate and interest rate hikes likely have bigger long-term implications for the global economy and markets than the ongoing conflict. Russia and Ukraine combined are less than 1.5% of global GDP. That said, the situation in Ukraine is likely to be a bigger short-term driver of markets, either positive (e.g. in a ceasefire scenario), or negative (e.g. if gas supply to Europe is cut). As a result, the news cycle and investor attention will be disproportionally focused on this conflict in the short term.

The risk du jour is constantly changing. While big tail risks (extreme, but low probability events) like war, credit crunches and unexpected election results get a lot of attention in the media, the risks often never eventuate or play out as badly as feared.

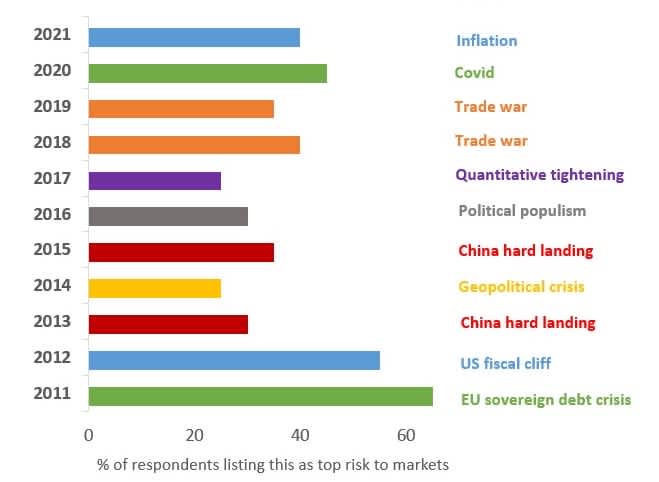

The table below shows the biggest area of investor concern each year since 2011, as measured by the Bank of America Global Fund Manager Survey.

Last year the biggest concern for investors was inflation, this year I’m willing to bet it is Ukraine. The US-China trade war loomed large for two years but did little more than create some mild market volatility in 2018 and 2019. The US market is up nearly 50% since the start of the trade war.

The 24-hour news cycle makes it easy to focus disproportionately on these vivid issues. With the amount of news coverage they get, it can be easy to assume some of them are certainties, rather than just possibilities.

The narrow focus on tail risks can do more harm than good - causing investors to sell out of the market at the wrong time and miss out on the long-term compound growth share markets have delivered. Famed investor Peter Lynch captured this idea well when we said that “far more money has been lost by investors trying to anticipate corrections, than is lost in the corrections themselves.”

Staying the course

Markets are often said to climb a wall of worry. When the list of issues is long and investors are pessimistic, markets become depressed. When risks are gradually resolved, perhaps simply through the passage of time, markets climb as the wall of worries starts to shrink. While it may feel counterintuitive – you want to be buying when the list of issues is long, not short.

As always, we encourage investors to take a long-term view, select the right investment strategy for their risk tolerance, and then patiently stay the course. Switching strategy when markets are turbulent can result in investors turning a short-term loss into a permanent one.