“If you've got the power to raise prices without losing business to a competitor, you've got a very good business.” - Warren Buffett

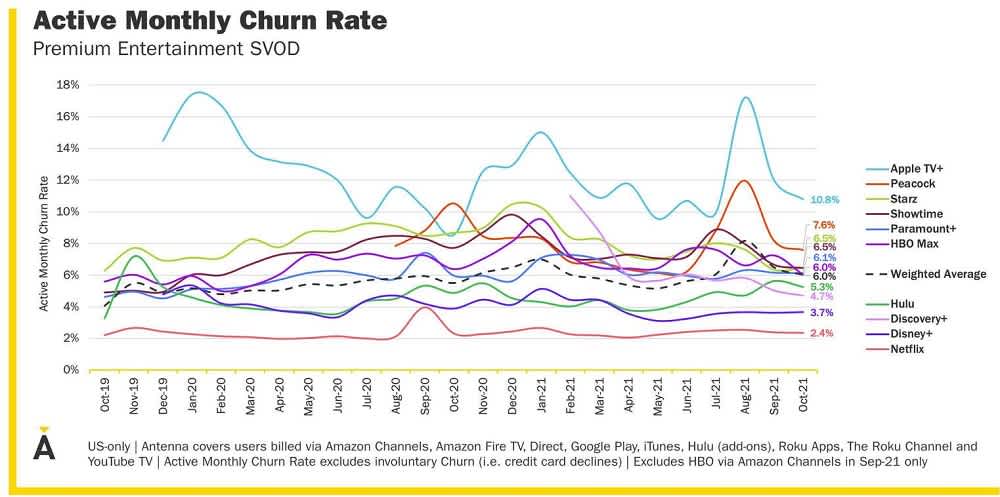

Netflix has raised subscription pricing five times in the last seven years, with the price of a standard subscription increasing 6% p.a. or 55% cumulatively over that time. Despite this, it has maintained best-in-class churn rates below that of popular peers such as Disney Plus. We think this is an impressive demonstration of Netflix’s pricing power, an attribute we look for in our search for quality businesses to invest in.

A streaming leader with global scale and quality content

Netflix is the world’s leading streaming service with 222 million members in over 190 countries. The company was a first mover in offering subscription video on demand (SVOD), and recognised the importance of original content early on, launching its first series (House of Cards) in 2013. Since then, the company has reinvested most of its cash flow into creating award-winning original content, such as Stranger Things and Squid Game, that are only accessible with a Netflix subscription. In the company’s own words: “Netflix was the most Emmy-winning and most nominated TV network and the most Oscar-winning and nominated movie studio of 2021”.

‘Content is king’, goes the refrain. Netflix’s scale in content creation and ability to spread this cost over a huge global audience base gives it a significant cost advantage versus peers. Netflix can create more content than its peers, at a lower cost per subscriber, allowing it to continually improve its user value proposition. We believe this advantage will only get stronger with time. This scale and content advantage, combined with a large global addressable market (750 million potential subscribers ex-China) and pricing power, supports our view that Netflix is a quality business with a wide moat, large growth opportunity, and an exceptional management team.

Netflix’s pricing power is earned, not given

Netflix has a relentless focus on pleasing its subscribers and increasing its share of consumers’ leisure time that may otherwise be spent on competitor streaming services or alternative entertainment such as gaming, social media, and off-line socialising. Netflix spends more than half of its revenue each year on content, and the investment is paying off. Back in 2012, an average subscriber spent over an hour a day watching Netflix, this doubled to two hours a day by 2019 and jumped to over three hours in 2020 as pandemic lockdowns restricted out-of-home entertainment options. That’s over 90 hours watched each month for the price of one or two movie tickets, with the cost becoming even more negligible if we account for multiple users sharing a single subscription. This gap between Netflix’s pricing and its value proposition creates an advantage that allows the company to increase prices without alienating many users, as evidenced by its low churn rates.

In late 2021, Netflix added to its value proposition by offering mobile games as part of members’ regular subscriptions (i.e., at no extra cost). We think this move helps Netflix keep pace with demographic trends – a recent Hub Entertainment Research report found younger consumers (24 and under) spend only 25% of their screen-based leisure time watching TV and movies versus 60% for older consumers (35 and over), while the same younger consumers spend 25% of that time gaming versus 11% for older consumers. This focus on increasing relevance across age cohorts is likely to lead to even lower subscriber churn, which increases revenue.

Adding Netflix to the international portfolio

While we have long admired the company, Netflix has always traded at a valuation we viewed as too expensive. Recent share market volatility and what we see as some temporary headwinds facing Netflix (it issued weaker than expect growth guidance for Q1 2022) gave us the opportunity to buy the company’s shares at a 45% discount to its November 2021 highs. Temporary swings in subscriber growth are not new to Netflix and can be impacted by the timing of content releases, pricing changes and macroeconomic developments – but we believe its large and growing lead in content and commitment to user enjoyment will ensure it continues to gain subscribers for many years to come. We also remain confident in the company’s ability to continue raising prices at a rate that lags the value of the content it delivers. Despite numerous price increases, a Netflix subscription still presents incredible user value compared to satellite or cable television.

As equity markets are off to a volatile start in 2022, a silver lining is the opportunity to purchase companies where their price is not reflective of their value. Amidst the ongoing market ups and downs, we continue to look for quality businesses that will do well over the long term.