Most of us were pretty happy to say goodbye to 2021, but if you are still feeling a little gloomy, you’re not alone. Aside from COVID-19 and its many iterations, we have been left with record levels of inflation and rising interest rates. A perfect storm for homeowners, struggling to meet increasing living costs, pay down the mortgage and save for retirement.

In the many surveys and questionnaires around how to meet the challenges of rising prices, there is often advice around planting your own vegetables, taking your lunch to work, and forgoing the takeaway coffee, but there is seldom any mention of what surely is the most important issue for investors – outpacing the impact inflation will have on their retirement nest egg.

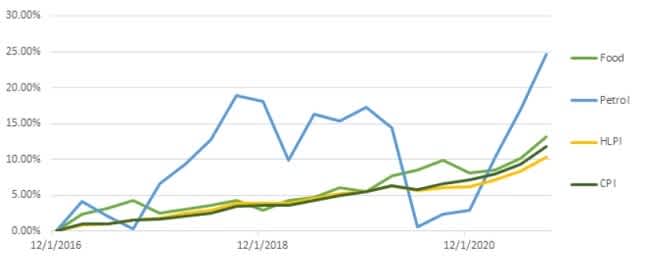

All prices indexed from Dec 2016. Chart: Fisher Funds. Source: Statistics NZ.

Whilst returning to a thriftier way of life as an antidote to inflation has merits, it does not address a seldom considered issue - the significant increase in life expectancy that we have seen over the last few decades. In 1970, life expectancy was 68.5 years for men and 74.6 for women; it’s now 80 years and 83.5 years respectively (source: Statistics NZ). Where once ‘The Super’ only had to last you 6-10 years, now it’s more like 15-18+ years. Those retirement savings need to go the distance.

Future proofing investments in the face of inflation requires investors to be long term in their perspective, to be bold and take a strategic approach. In the same way that term deposits alone can no longer suffice, retreating to the relative safety of a defensive strategy is also no longer viable. Being strategic and ensuring that you have the right level of exposure to growth assets, based on your age and investment goals, is essential to meet the inflation challenge head on.

Appropriate diversification and active management are two methods that Fisher Funds uses to help deliver superior risk-adjusted returns; and while investing in growth assets does come with some risk, the opportunity cost for investors being overly conservative could be high. Our advisers work with you to ensure that your strategy is consistent with your investment timeframes and your goals and expectations. We might not be able to prevent the tentacles of 2021 reaching into 2022, but with our gaze firmly fixed on the future we can work together to move boldly towards it.

As always, we’re here to help, so if you would like to talk to someone about your investments or your investment strategy, please contact us or get in touch with your Adviser.