Interest rates act as gravity in financial markets, and with rising interest rates starting to provide a downward force, the next ten years may be a harder slog than the last ten. While the going may be tough, that doesn’t mean the rewards won’t be worth it for patient investors.

A year for the history books

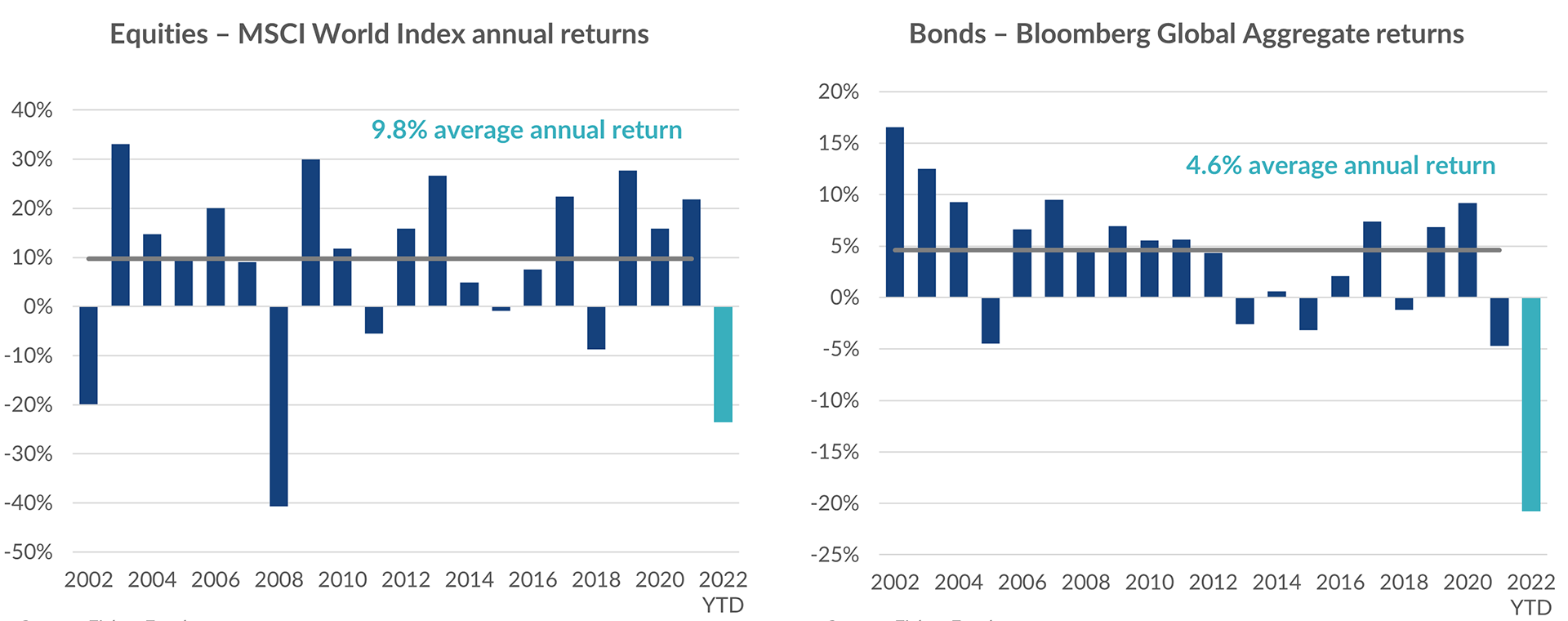

At the three-quarter mark, this year has already been tough in financial markets. 2022 reminds me much more of 2012 and the drawn-out European debt crisis, than 2020 when markets recovered quickly from the COVID induced sell-off. No asset class has been immune. Global share markets are down over 20%; typically resilient bond markets* are also down 20% - making it the biggest drop on record; even gold, often seen as a safe haven, is down 11%.

This year’s turbulence has been driven by soaring inflation, rising interest rates and the risk of recession. It comes after a decade of low inflation and falling interest rates that provided a goldilocks period for investors – not too hot, not too cold, but just right.

2022 is an abrupt reminder that risk and return are always tied at the hip. The price investors pay for higher long-term returns is uncertainty and short-term volatility. You have to earn your return.

Interest rates provide a gravitational force that anchors asset prices

Famed investor Warren Buffett once said that “interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

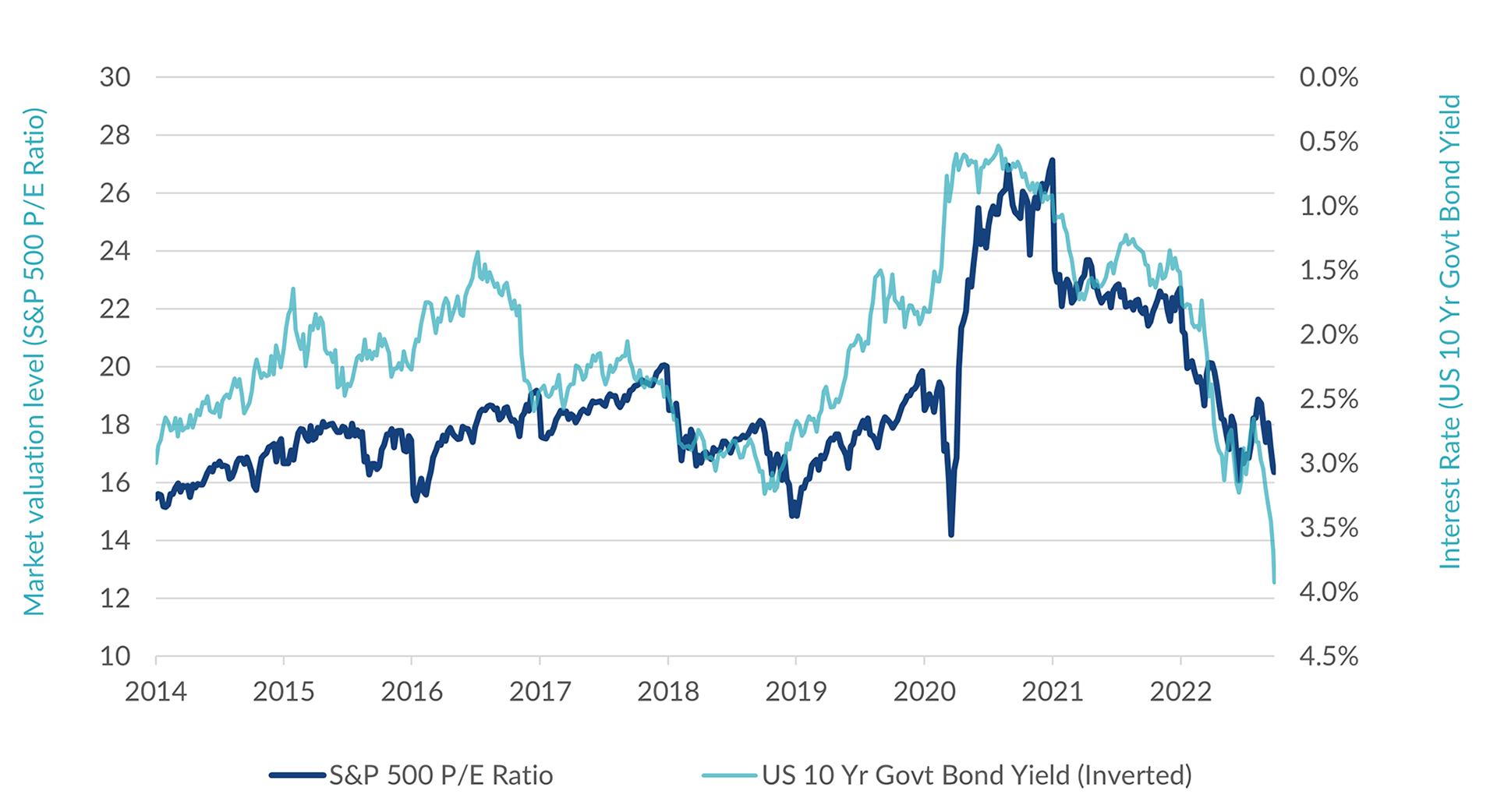

Following this logic, with interest rates rapidly increasing in recent months the downwards force being applied to asset prices has increased dramatically. Years of low and declining interest rates led to share prices soaring. Not only did companies grow earnings and pay dividends to investors – but they also saw their valuation multiples rise – leading to outsized returns over the last 10 years.

As can be seen in the chart below, with interest rates rising rapidly this year, gravity has pulled equity valuations back to earth. The elevated valuations of 2020 and 2021 have vanished and are now back at long term averages. As the old saying goes, is seems that “what goes up, must come down.”

The old normal

Over the last few years there was a lot of talk about a ‘new normal’ of low interest rates, and new habits we all adopted through the pandemic. However, with the recent rebound in interest rates and inflation, and people gradually returning to the office and travelling, perhaps the new normal isn’t that different after all.

Gravity has already reasserted itself. Unless interest rates push ever higher, then the headwind that has been impacting markets will begin to dissipate. That said, with the laws of physics no longer suspended, ever-increasing valuation levels are also less likely to drive markets higher. Investors will have to get their returns the old fashion way – through companies growing their earnings and paying dividends.

What this means for investors

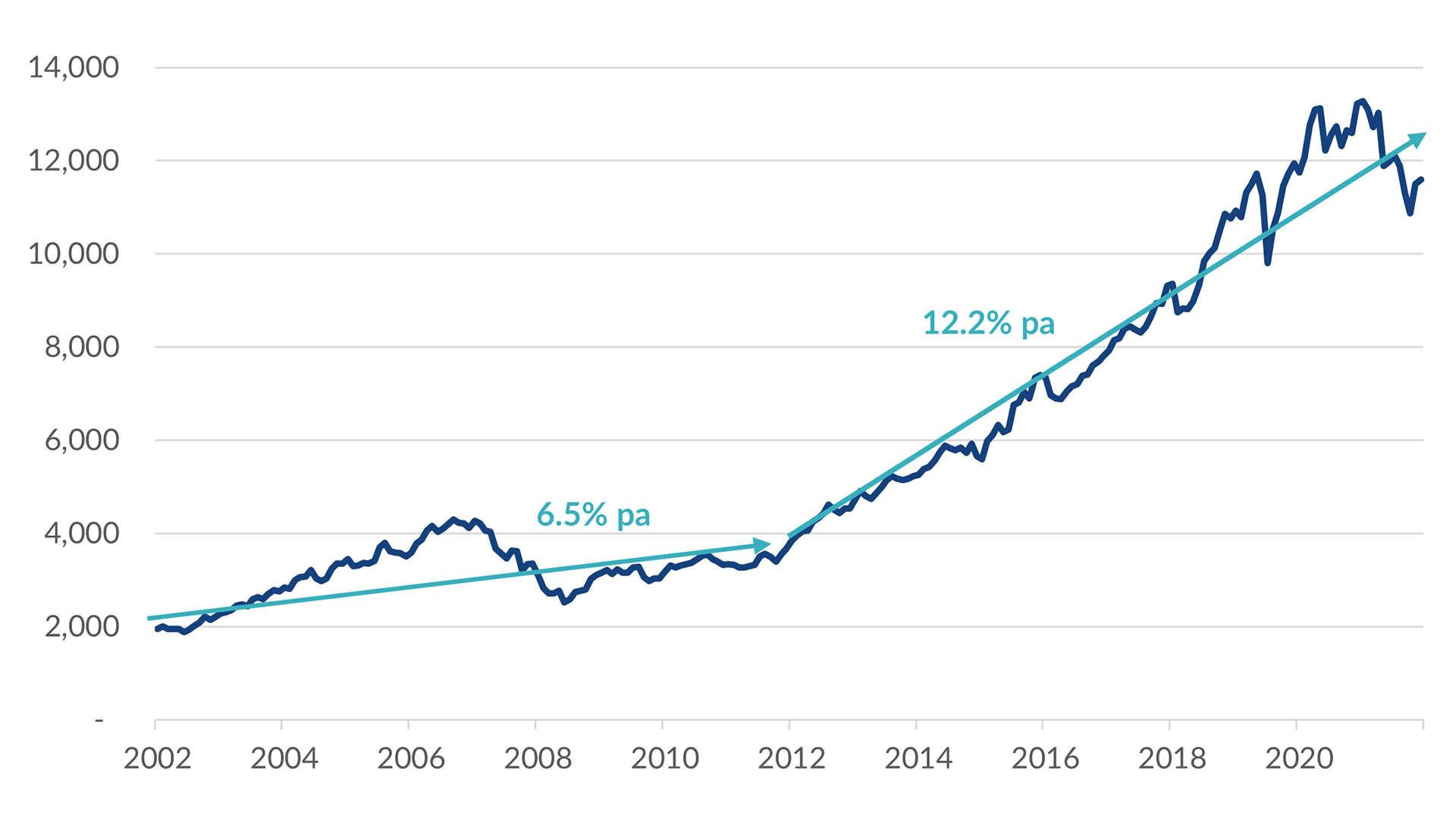

Having personally invested in the share market for over 20 years now, I have come to appreciate that there are periods when markets seem like plain sailing, and periods when it seems like a hard slog. The first 10 years of my investing journey felt like a hard slog, whereas the last 10 years have been much smoother sailing. New Zealand’s NZX 50 Index illustrates this point well.

Over the last 10 years the New Zealand share market has delivered an average annual return of 12.2% per annum. In the 10 years prior to that it delivered an annual return of just 6.5% per annum – and with a brutal financial crisis in the middle.

While markets were much stronger over the last ten years, the reality is that the results in both periods were still solid (as they have been in most 10-year periods throughout history).

In the second 10 years $100,000 would have increased in value more than three-fold to c.$320,000. In the first 10-year period $100,000 would have still increased in value to $180,000 and far outstripped the effects of inflation. Over the full 20-year period, $100,000 would have increased in value to almost $600,000.

This ‘on again, off again’ nature of markets isn’t unusual. Markets have always been pushed around by uncertainty and unexpected events. If anything, the last decade has been abnormal in terms of its relative stability. Even if the old normal is returning and investing becomes more of a hard slog, we believe patient investors will still be handsomely rewarded.

* As measured by the Bloomberg Global Aggregate Index

If you would like to talk to someone about your investment strategy, the team at Fisher Funds are here to help. Please contact us or get in touch with your adviser.