Last month I was on the road. Visiting management of portfolio companies, meeting their key competitors and searching for new investment ideas. I was on the lookout for companies that operate in an industry with a large and growing end market.

One such company is HomeServe. I have loosely followed their progress over the last year. While in London, it was a good opportunity to meet senior management.

Replicating HomeServe’s success in the US market presents a huge opportunity

The company’s core business is an insurance intermediary for home appliances, such as boilers or other plumbing and heating needs. HomeServe partners with utility companies, who sell polices on HomeServe’s behalf for a commission. HomeServe collects policy fees after underwriting costs and income from repair services.

The company is entering the US where HomeServe sees ample opportunity. Currently 8 million US households have home appliance insurance. The same number as the mature UK market. However, the 135 million households in the US is five times the size of the UK.

The US resembles a $3.75 billion market opportunity for HomeServe. Penetration of home appliance insurance is 30% in the UK. If the US reached the same penetration, it would imply additional 30 million households. Each policy is potentially worth $125 for HomeServe.

Leveraging their relationships with tradespeople to create an online platform

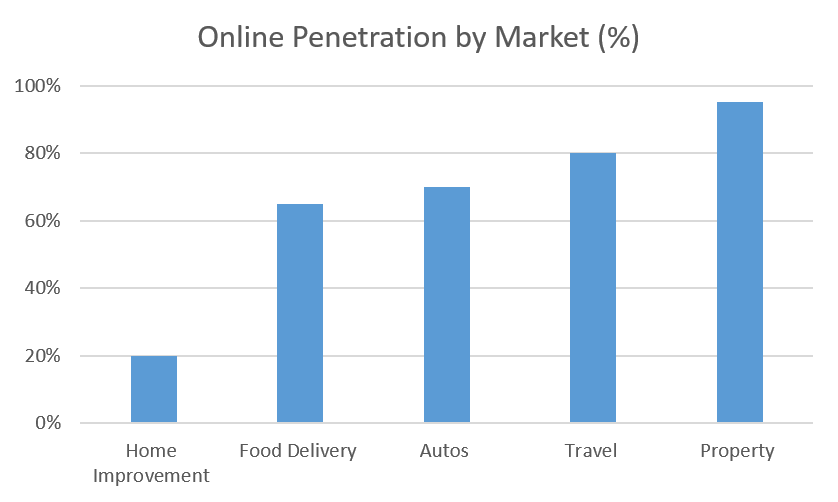

HomeServe also runs an on-demand home services online platform, Check-a-trade. Today in the UK, around 600,000 tradespeople serve a £35 billion market for home improvement. Only around 15-20% of spend is sourced online. HomeServe is able to leverage relationships the company has with tradespeople for home appliance insurance.

The sector should continue to migrate online. Following other consumer service industries such as food delivery and travel with greater than 60% online penetration. This provides HomeServe with another attractive growth prospect.

Check-a-trade is trying to remove friction and increase transparency. Currently most consumers find trades people through word-of-mouth.

The platform provides a trustworthy online directory for home improvement. Tradespeople pay a yearly subscription to Check-a-trade. To be eligible, tradespeople have to fulfil a list of background checks. Consumers can go on the platform, read and check reviews.

Check-a-trade faces competition from Rated People and MyBuilder. No participant has a commanding market share yet. Platforms are generally a winner take most model benefitting from virtuous cycle. More consumers on the platform, the more tradespeople, greater the selection, which brings more consumers to the platform.

A large and growing market, but does HomeServe have what it takes to win?

HomeServe operates in a large industry, with good growth prospects. This is a good start. Now the real work starts to understand if the company could be worthy candidate for our portfolio. We spend most of our research time trying understand if a business has a competitive edge that will allow them to capture this growth. Or will a competitor beat them to it?