Kiwis love to travel. Extending the same adventurous spirit to your investment portfolio can be rewarding and reduce risk.

Having grown up in small town New Zealand I always wanted to travel. See the world, explore big cities, see the bright lights. Many Kiwis have the travel bug and our travel stats show that we love to travel to exotic locations - we don’t just jump across the ditch.

While we may be adventurous travellers, when it comes to investing, Kiwis can be overly cautious and prefer to stay at home. New Zealand investors are limiting their options and actually taking more risk by avoiding investing in global shares.

Would you invest 100% of your wealth in a small island nation?

Many Kiwis have over 90% of their wealth tied up in New Zealand property, shares and bank deposits. This has worked recently. We have been lucky in New Zealand to benefit from a strong economy and property market for over a decade. We also have some great businesses in New Zealand and The a2 Milk Company, Fisher & Paykel Healthcare, Mainfreight and Xero are great examples that our New Zealand Growth Fund invests in.

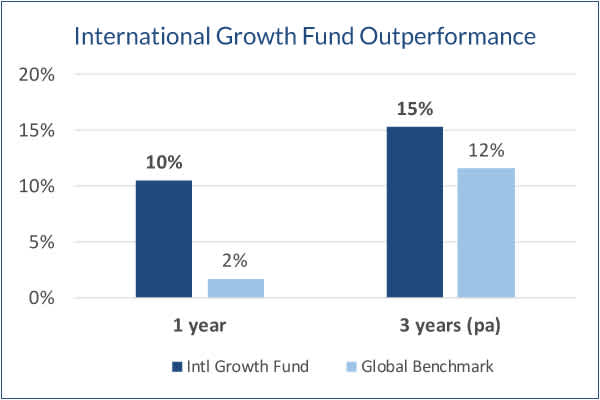

Regardless of how great these companies are, or how strong our economy has been, it isn’t wise to have all your eggs in one economic basket. Those of us that remember New Zealand’s 1987 crash will understand this point better than most. Investing in foreign shares can reduce your portfolio’s risk and offer great returns.

Benefiting from the growth of world leading businesses

Technology has broken down international borders. Refrigerated shipping, containerisation, air travel, telecommunications - and now the internet. This has driven globalisation and many of the fastest growing and most profitable businesses operating in New Zealand are foreign. Companies like Uber, Netflix, Facebook, PayPal, Google, Amazon and salesforce.com are great businesses and many of us use their services. Assuming the numbers stack up why wouldn’t we consider investing in them, so we can also benefit from their growth?

Investing globally can provide exposure to secular growth themes investors can’t easily access in New Zealand. Areas like ecommerce, online advertising, digital payments and cloud computing. As with travelling, there are some great things to see and explore in New Zealand, but there are many more beyond our borders.

Active stock picking can amplify these benefits

There are thousands of companies globally to invest in. This huge array of choice creates its own challenges and only a subset of these companies will make great investments.

We are looking to invest in high quality businesses with long growth runways. And our aim is to buy these businesses when the market doesn’t fully appreciate this growth potential.

By managing a concentrated portfolio of just the best 20-30 investments we can find globally, we keep the bar high and say no to most ideas. Despite lots of travel and thousands of hours hunting, we only find a handful of attractive new investments each year. We believe this highly selective and patient approach ultimately leads to better returns.

Global shares can add a lot to your portfolio

With over 99% of the world’s listed companies beyond our borders there are lots of great opportunities out there for those willing to travel. Not only do global shares provide a broader set of opportunities and potential for profit, but they also help reduce risk.