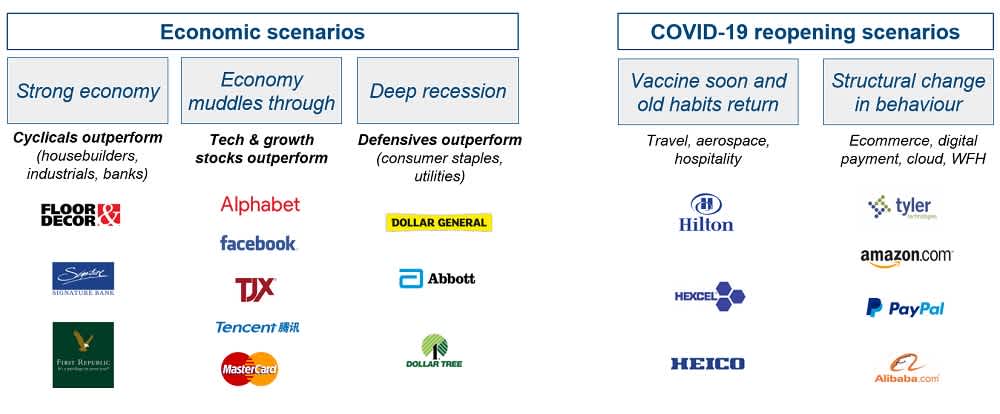

When building a portfolio it is important to invest in a range of businesses that perform differently in a range of different scenarios. Diversification across sectors and between both cyclical and defensive businesses helps reduce portfolio volatility and exposure to any one unexpected scenario (like COVID-19).

In constructing our portfolio, we are consistently accessing how different scenarios will affect performance. These may be economic or behavioural based. This is akin to saying we don’t want all of our eggs in one basket. Using this structure helps to create an all-weather portfolio, reducing exposure to any one scenario.

This has been particularly important in 2020 as it feels like we have had a fully economic cycle in just a few short months, compared to the standard seven-to-eight years.

From March, most of our returns and the broader market have come from companies termed COVID-19 beneficiaries - like Amazon and Paypal, which both benefitted from a two-to-three-year pull forward in online shopping adoption.

The rotation from the year’s biggest winners into the year’s biggest losers

In November this changed with positive news related to the efficacy of COVID-19 vaccines causing a rotation from many of this year’s leaders into the year’s biggest losers. For example, the cyclical S&P Industrials sector had its second strongest month ever in hopes that the vaccine will contribute to a strong economic rebound in 2021.

Our portfolio witnessed the same dynamic. During November, our ‘old habits return’ bucket, made up predominantly of industrial and cyclical businesses, performed very strongly, somewhat offsetting their underperformance earlier in the year. The group includes aerospace component manufacturers Hexcel (+48%) and Heico (18%), conference and research provider Gartner (+19%), and hotel brand franchisor Hilton (+18%).

The latter three of these companies were added to the portfolio during March when equity markets had fallen significantly. Our investment thesis at the time was simple, these are quality growth companies, with strong balance sheets, whose businesses had simply been hit by COVID-19. Our expectation was that the share prices of these companies should perform strongly when the world eventually returned to a more normal environment (whenever that might occur).

Constantly reassessing scenarios

Recent announcements of COVID-19 vaccines have raised the possibility that economic growth could surprise economists' estimates to the upside. As such, we have recently increased our weighting to our ‘strong economy’ bucket. We believe this selection of companies has yet to be re-priced higher relative to the wider market and could offer significant return potential in an environment of strong economic growth.

First Republic Bank

One of the changes we made recently was adding First Republic Bank to the portfolio. The bank is a high quality, founder run company with a best-in-class business model. First Republic provides services to high-net-worth households in select markets. The bank has consistently generated superior loan growth, while maintaining extremely prudent lending standards. In addition, by providing its customers with exceptional personalised service, the company has built more profitable relationships by offering other products including its wealth management services. The company is also working to broaden its reach to emerging professionals and younger millennial households, which can be additive to the overall growth rate.

What 2020 has made clear is no investment manager has a crystal ball into the future, highlighting the importance of an all-weather portfolio that can do well in a range of scenarios. We believe this can be achieved while also staying true to our overarching investment philosophy of investing in high-quality growth companies.