The pandemic the world is faced with right now has accelerated structural tailwinds already driving Amazon’s growth.

I was chatting with a friend the other week who lives in Canberra. He mentioned the ever-increasing number of Amazon branded boxes arriving on his doorstep, as he gets deeper into lockdown with two young kids.

Perhaps Josh Brown of CNBC said it best. “Amazon became a utility in this crisis – defensive, reliable, indispensable.”

In our view, just as the pandemic has been the last roll of the dice for some companies, the virus has accelerated the structural tailwinds that were already driving Amazon’s growth. Most notably, e-commerce and cloud computing. The Amazon share price has responded favourably, rallying from $1,900 to record highs of $2,408 in the last month.

Amazon’s e-commerce moat

E-commerce has been growing as a portion of overall retail sales and Amazon is the dominant platform in the west. The company commands a near 50% market share of US online sales, or 5% of total retail sales. Amazon is both a reseller of goods and a platform (marketplace) for third parties.

The company’s e-commerce competitive advantage versus peers continues to widen. Competitors are unable to compete with the capital investment required to deliver Amazon’s customer proposition of price, availability and convenience.

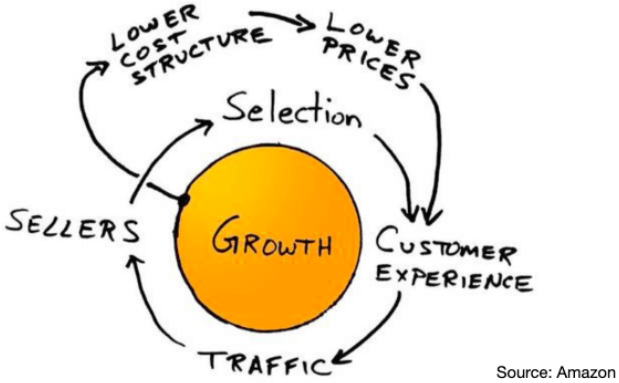

What is unique about Amazon versus competitors is while 70% (US$200 billion) of last year’s revenue was generated from e-commerce, it only contributed around 7% of Amazon’s operating profit by our estimates. Because the e-commerce giant has other high margin revenue streams, Amazon is able to invest online earnings back into the business to drive the Amazon flywheel (see diagram). The most recent example is Amazon's shift to one-day shipping for US Prime subscribers from two-days.

It is best to think of Amazon’s e-commerce business as a data company. In our opinion, Amazon monetises e-commerce through Amazon Marketing Services (AMS). The firm uses information about past purchases, product reviews and location. Combined with the unique advantage that consumers using its site usually intend to buy things right away. Amazon can deliver targeted ads. This model works for Amazon given its importance as a distribution channel for manufacturers and suppliers. With so many customers visiting Amazon's website, companies have a willingness to pay for product placement or promotion. It allows Amazon to benefit from another structural tailwind – the shift of ad dollars from offline to online.

Cloud Computing

Two-thirds of Amazon's profit comes from its cloud computing business, Amazon Web Services or AWS. The data storage and processing services AWS provides, underpin the operations of many businesses meaning demand for the service has been surging as more people are working remotely.

The migration to the cloud has been happening for about a decade. Firms are increasingly opting not to make costly investments in their own IT infrastructure. Instead, through companies like AWS or Microsoft, they can rent processing hardware and software. This means paying as they go for storage and data processing features. With exponential growth in data, we expect a continuation of this trend.

Amazon’s business has benefitted from Covid-19, but this is not transitory. The company was already positioned at the centre of long-term structural trends, which we think will underpin growth for years to come.