Share markets have had a rollercoaster ride so far this year, and understandably the ups and downs have made some investors and market commentators nervous. But turbulence is a natural feature of markets. For long-term investors it can actually be a blessing in disguise.

Rollercoaster ride

I took my kids to Rainbow’s End recently, and while the ups and downs of the rollercoaster weren’t as frightening as I remember as a kid, they were certainly enough to terrify my 9- and 10-year-old! At least on the first ride.

Markets can have a similar effect on investors. Your first experience with market volatility can be extremely nerve-racking. Even for experienced investors, watching your account balance decline day after day is never comfortable. But after you’ve lived through a few bouts of volatility the nerves become dampened, and you may even start to see volatility as a source of opportunity.

The new year has already been far more volatile than 2021. At one point the MSCI World Index had fallen 10% from its highs, before bouncing recently to end the month down just 5%.

While the causes vary, turbulence is a regular feature in markets

The market jitters this year have been caused by concerns around rising inflation and interest rate hikes by central banks, but there is always something to spook markets. The last big sell-off was caused by the initial discovery and spread of COVID-19 in 2020, before that we have had taper tantrums, the US-China trade war, the European sovereign debt crisis, and of course the global financial crisis. All this turmoil occurred in just over a decade.

These setbacks are a regular occurrence. Using the US market as an example, there has been a 10% market decline every 24 months on average, and a 20%+ market decline about once every seven years.

Chief investment officer, Ashley Gardyne, discusses the current market volatility and what may be causing it.

Heighted volatility may be a blessing in disguise

The extreme movements we saw in markets in March 2020 (when markets fell by 30% in just a few short weeks) created more attractive investment opportunities than we had seen since the global financial crisis. The rich pickings during that period helped our funds outperform materially as markets recovered.

While the recent sell-off in markets hasn’t been as severe, it has still resulted in opportunities for active investors to capitalise on.

As one example, we have recently bought shares in Netflix for the first time in our International and KiwiSaver portfolios. Netflix is a company we have long admired. It is the world’s leading streaming service with over 200 million subscribers in over 190 countries. Netflix recognised the importance of original content early on, launching its first series (House of Cards) in 2013. The company’s scale in content creation and ability to spread this cost over its huge global audience base gives it a significant cost advantage versus peers. It can create more content than its peers, at a lower cost per subscriber, allowing it to continually improve its user value proposition. We believe this advantage will only get stronger with time. While we have wanted to buy into the company for a long time, it has always traded at a valuation we viewed as too expensive. With the sell-off in growth stocks in recent months, and what we see as some temporary headwinds facing the company, we were able to buy Netflix at a 45% discount to its November highs.

Purchases like these – at times of elevated fear - can make a significant difference to returns over the long term. In a world of lower prospective returns (just look at term deposit rates), taking advantage of volatility is an important lever to enhance returns. This volatility may be a blessing in disguise.

Adopting a longer timeframe can also help dampen volatility, and focus investors on the real prize

Focusing on 1-month or 1-year returns in markets, which are subject to the vagaries of human behaviour, isn’t at all helpful. Share prices get divorced from reality significantly over short periods of time. Over the longer term however, the share prices of companies tend to follow underlying economic fundamentals.

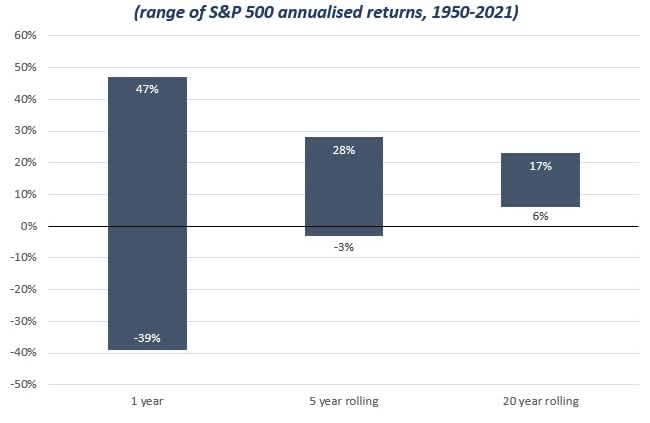

Looking at share market data from the US market since 1950, returns over a one-year period have ranged from -39% to +47% in the worst and best calendar years. A wide and perhaps worrying range. However, if you had the 20-year time horizon of many investors (the average KiwiSaver investor is in their mid-forties), the worst return you would have received if unlucky would have been +6% per annum. Not a loss, but a +6% return, which would turn $10,000 into $30,000 over 20 years (in the worst-case scenario). Over that whole period the average annualised return for the US market was over +11% per annum - enough to turn $10,000 into $80,000 over 20 years.

Share markets aren’t often as smooth sailing as they were in 2021. But despite the bumps along the way, the market has still delivered great returns over the long term. The cost of the better returns available in equity markets is enduring the volatility along the way. If you have the temperament for it, the payoff is significant. $10,000 invested in the US market back in 1990 would now be worth over $260,000

In a world focused on short term gains, this idea of ‘time diversification’ doesn’t get enough attention. It can be a helpful way for investors to get comfortable adopting a long-term investing orientation.

None of this is to say that there won’t be more volatility in the weeks to come, but we’ve been on this rollercoaster before, and investors that have held the course have typically prospered.