What are the fees for Fisher Funds Managed Funds?

Fisher Funds charges a fee to actively manage your investment in the Fisher Funds Managed Funds Scheme.

The table below shows the annual fund charges for each fund including GST, if any. Estimates are reasonable estimates of future costs, expenses and fees which are likely to be charged in the future based on a combination of historic and forecast charges.

Mixed asset portfolios

Investment option | Fixed Manager's basic fee | Estimated other management and administration charges | Total estimated annual fund charges (% of net asset value) |

Conservative Fund | 1.12% | 0.24% | 1.36% |

Balanced Strategy | 1.21% | 0.22% | 1.43% |

Growth Fund | 1.27% | 0.20% | 1.47% |

Sector investment options

Investment option | Fixed Manager’s basic fee | Estimated other management and administration charges | Estimated performance-based fees* | Total estimated annual fund charges (% of net asset value) | Potential range of performance-based fees |

Income Fund | 0.76% | 0.25% | n/a | 1.01% | n/a |

Property & Infrastructure Fund | 1.27% | 0.21% | 0.15% | 1.63% | 0% to 2.00% |

New Zealand Growth Fund | 1.27% | 0.16% | 0.00% | 1.43% | 0% to 2.00% |

Australian Growth Fund | 1.27% | 0.19% | 0.01% | 1.47% | 0% to 2.00% |

International Growth Fund | 1.27% | 0.18% | 0.00% | 1.45% | 0% to 2.00% |

- *

Performance-based fees are estimated. Where applicable, the annual fund charges include a performance-based fee estimate based on the long term average performance of the fund's appropriate market indices compared to the long term performance of the hurdle rate of return of the fund.

Performance fee

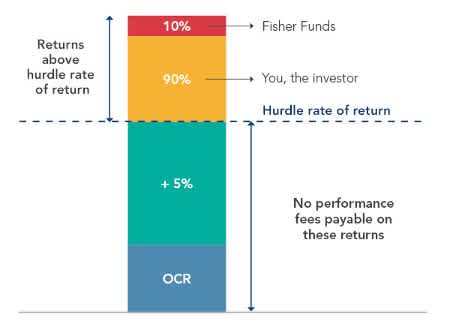

We believe performance fees are a good way of aligning our interests with yours to achieve great investment returns and grow your retirement savings.

Here’s how the performance fee works:

Element | Description | Fee Structure |

|---|---|---|

Hurdle rate of return | The return* that must be achieved before a performance fee begins to apply. | The Official Cash Rate (OCR) + 5%. Note that in the Property and Infrastructure Fund the hurdle rate of return is the OCR + 3%. |

Fee on return above the hurdle rate | The amount of the return above the hurdle rate of return that is paid to Fisher Funds. | 10% (members receive 90%). |

Performance fee cap | The maximum performance fee that can be paid to Fisher Funds in any year. | 2% p.a. of Average Net Asset Value of the fund. |

High Water Mark | Where the portfolio value goes up and then down over multiple periods, this ensures that no performance fee is payable if the Manager has previously been rewarded for that performance. | No reset allowed. Where the 2% cap limits the performance fee, the High Water Mark will be set at the performance level at which the cap was triggered. This means the Manager will not be rewarded for the same performance twice. |

Fee frequency | How often the fee is paid. | Annually. |

For full details of the performance fee formula, see the Scheme's Other Material Information document.

- *

"Return" means the increase in the unit price of the funds, which is after management fees but before deducting any PIE tax that may be payable by individual investors.

What does this look like in practice?

Subject to beating the hurdle rate of return and the unit price being above the High Water Mark, we are entitled to earn a performance fee of 10% of excess returns. This means that at an OCR for the year of say 3.00%, using the New Zealand Growth Fund as an example, we would receive no performance fee on the first 8.00% of your return (after all other fees). But for any return achieved in excess of 8.00%, members would receive 90% and Fisher Funds would receive 10% (up to a maximum of 2%). The table below shows how the returns achieved by Fisher Funds would be shared assuming a 8.00% (OCR of 3.00% + 5%) hurdle rate of return:

Investment Return (after the deduction of annual fund charges) | Member share | Fisher Funds share (performance fee) | Total Fee (Annual fund charge + Performance fee) |

|---|---|---|---|

8.00% | 8.00% | 0.00% | 1.43%+0% = 1.43% |

10.00% | 9.80% | (10%-8.00%) x10% = 0.20% | 1.43%+0.20% = 1.68% |

15.00% | 14.30% | (15%-8.00%) x10% = 0.70% | 1.43%+0.70% = 2.13% |

20.00% | 18.80% | (20%-8.00%) x10% = 1.20% | 1.43%+1.20% = 2.63% |

25.00% | 23.30% | (25%-8.00%) x10% = 1.70% | 1.43%+1.70% = 3.13% |

30.00% | 28.00% | 2.00% cap applies | 1.43%+2.00% = 3.43% |

In the case of the Property & Infrastructure Fund the hurdle rate is the OCR + 3%. The performance fee paid to the Fisher Funds and the total fee charged to clients would be higher in that fund as a result. As a reminder the High Water Mark also remains in place to ensure we are not rewarded for the same performance twice.

Buy and sell spreads

Although under normal trading and market conditions Fisher Funds doesn’t apply buy and sell spreads, Fisher Funds may choose to do so - for example, during periods of exceptionally high transaction volumes.

You can find out if any buy or sell spreads have been applied here.

Got questions?

We've got answers.

Our team is available to tell you more and answer any questions you may have. Chat with us online or request a call by clicking the button below.